Demat Account helps investors to hold shares and securities in electronic format. it stands for dematerialisation. It helps you to keep a track record of all the investments done by an individual in shares,exchange –traded funds bonds and mutual funds in one Place. You can quickly transfer your shares . you can open the demat account with Any DP (Depository Participant) DP stands as financial institution or broker that allows trading on its platform. There are two central depositories in India, NSDL and CDSL. Any invester can hold more than one demat account linked to one pan card. There is no required minimum balance you have to maintain to open a Demat Account.

If you want to apply for an IPO you need a Demat Account. it allows applications for IPOs , trading of shares and mutual Funds and also facilitates the trading of government.

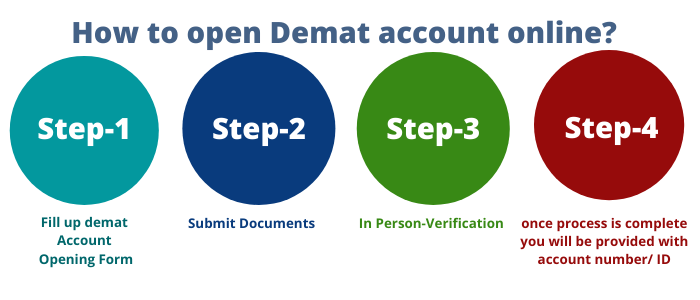

Step by Step Guide to open A Demat account Online

Visit the authorized website of the DP as per your choice.

Click on Open demat Account

Fill the details Like Name, Address , Mobile Number etc.

You will receive an OTP on your mobile number enter it in to the display box

Fill your Pan details and Aadhaar details on website

After submitting all the required details you will receive mail or call from the DP to confirm the details of the Account.

Step By Step Guide to open Demat Account Offline

After choosing the DP fill the designated form and KYC Form.

Attach passport size photos and photocopies of the Pan Card, Cancelled Cheque, Residence Proof and ID proof.

You need to carry original documents with you for verification.

After submitting the documents the DP will contact you and inform you about the details of Demat account.